If you are a property owner in Bangalore, you are required to pay property tax to the Bruhat Bengaluru Mahanagara Palike (BBMP) every year. The property tax is used by the BBMP to maintain and improve civic amenities in the city. It is important to pay your property tax on time to avoid penalties and legal action. In this article, we will discuss how to pay property tax in Bangalore (BBMP).

Pay property tax in Bangalore (BBMP) in 8 steps

Step 1: Click open the website BBMP property tax system – To begin the process of paying property tax in Bangalore, visit the BBMP property tax system website. You can find the link to the website on the BBMP official website or by searching “BBMP property tax online payment” on any search engine.

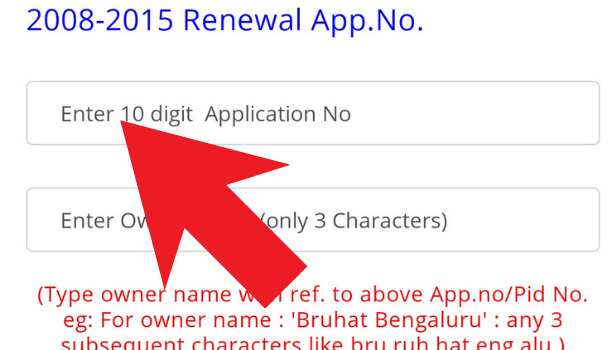

Step 2: Enter your application number, you can find it in any of your receipts – Once you have landed on the BBMP property tax system website, enter your application number. You can find your application number on any of your previous property tax receipts.

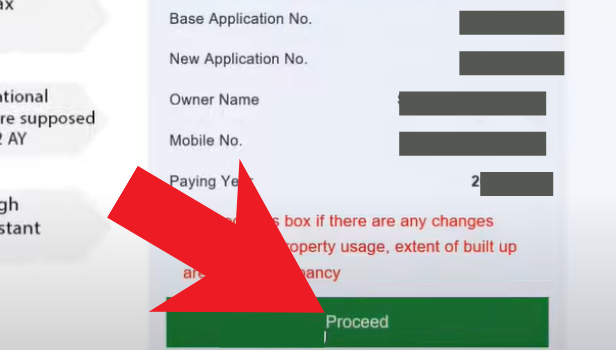

Step 3: After your information is visible, click on proceed – After entering your application number, your property details will be displayed on the screen. Verify the information and click on proceed.

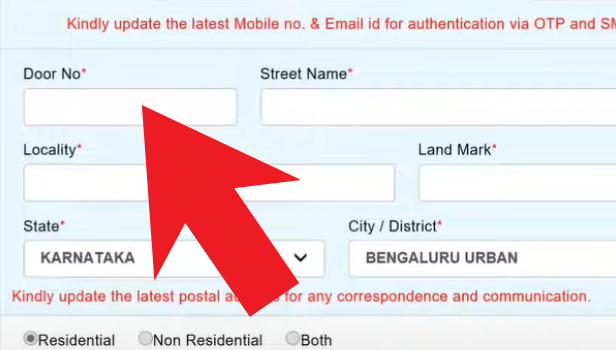

Step 4: Fill in your details – In this step, you need to fill in your personal details such as your name, contact information, and property details such as the built-up area, property type, and property use.

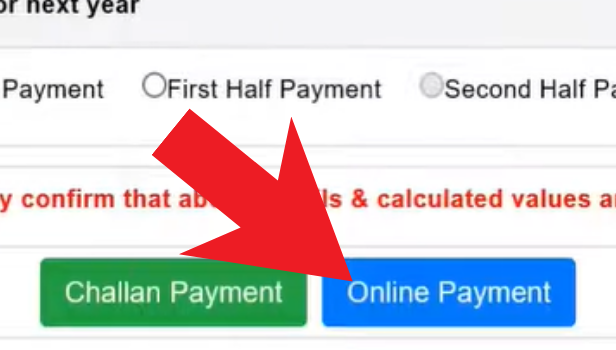

Step 5: Tick mark on confirmation and then click on online payment – After filling in your details, tick mark on the confirmation box and select the online payment option.

Step 6: Hit ok if your all entries are correct – Once you have selected the online payment option, review all the details entered by you. If you find any incorrect information, you can edit it. If everything is correct, hit ok.

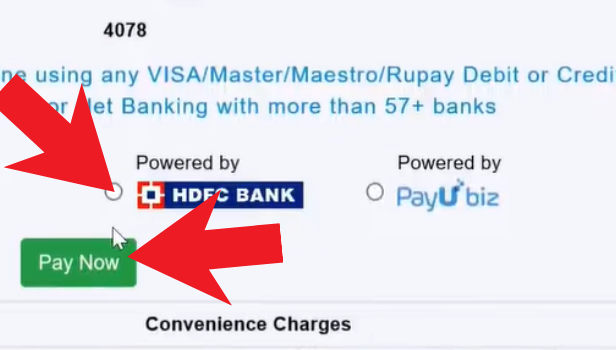

Step 7: click on pay now – After hitting ok, you will be redirected to the payment gateway page. Click on the pay now button.

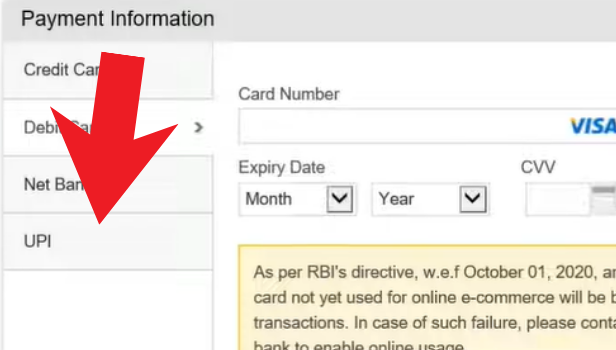

Step 8: Select your mode of payment, enter your details and make the payment – Select your mode of payment such as net banking, credit card, or debit card. Enter the required details and complete the payment. After the payment is successful, you will receive an acknowledgment slip.

Paying property tax in Bangalore is a straightforward process if you follow the above steps. It’s crucial to pay your property tax on time to avoid legal issues and penalties. Make sure to keep a copy of the acknowledgment slip for future reference.

FAQ

Q1. What is the deadline to pay property tax in Bangalore?

A1. The deadline to pay property tax in Bangalore is generally March 31st every year. However, due to the COVID-19 pandemic, the deadline may vary. It’s essential to keep an eye on the official BBMP website for updates.

Q2. Can I pay my property tax offline in Bangalore?

A2. Yes, you can pay your property tax offline by visiting any of the designated BBMP offices and paying through cash or cheque.

Q3. Can I pay my property tax in installments in Bangalore?

A3. No, you cannot pay your property tax in installments in Bangalore. You need to pay the entire amount at once.

Q4. Can I get a discount on property tax in Bangalore?

A4. Yes, you can get a discount on property tax in Bangalore if you pay the entire amount before the due date.

Q5. What happens if I don’t pay my property tax in Bangalore?

A5. If you don’t pay your property tax in Bangalore, you may face legal issues such as notices, penalties, and even property seizure